Program for filling out RSV 1. Reporting on insurance premiums, form. Where is the payment submitted?

Based on the results of 9 months of 2016 and for the entire 2016, policyholders must report to the Pension Fund of Russia using the familiar RSV-1 form (form). But starting from 2017, reporting on contributions will need to be submitted to the tax authorities using a different form, which, by the way, has not yet been approved.

No new form of RSV-1 appeared in 2016. That is, the RSV-1 form for 2016 looks the same as for 2015. You can download the PFR form RSV-1 from the website of the legal reference system Consultant Plus or from the Pension Fund website.

How to fill out RSV-1

In the RSV-1 PFR form, you need to fill out (and submit to the controllers) only those sections in which you have something to indicate. That is, if some section of the form remains empty, for example, section 2.4, which reflects the amounts of contributions accrued at additional tariffs, but you should not and do not accrue them, then you do not need to submit this section as part of the calculation.

The RSV-1 must contain Section 1 and Subsection 2.1 of Section 2, as well as a title page (clause 3 of the Procedure for filling out the RSV-1). The remaining pages are included in the calculation as needed. For this reason, the example below of filling out the RSV-1 Pension Fund form also does not include all sections.

Thus, the policyholder first fills out the necessary sections in the calculation, and then puts continuous numbering on each page.

Filling out the RSV-1 report: title page

Filling out RSV-1, like many other reporting forms, can begin with the title page. It indicates:

- information about the insured (registration number in the Pension Fund of the Russian Federation, name/full name of the individual entrepreneur, INN, KPP, OKVED code for the type of activity engaged in by the organization or individual entrepreneur, contact telephone number);

- code of the period for which the calculation was made, as well as the calendar year to which this period relates;

- the number of insured persons for whom information is provided in the calculation, i.e. sections 6 of the RSV-1 are completed;

- average number.

Be sure to also date and sign the title page. By the way, you will need to put “autographs” and dates in the same way on all pages of the calculation you prepared (clause 3 of the Procedure for filling out the RSV-1).

How to fill out section 6 of RSV-1

Oddly enough, after filling out the title page, it makes sense to start filling out section 6 of the RSV-1. For each insured person, a separate section is drawn up, which reflects:

- Full name and SNILS of the individual (in subsection 6.1);

- the amount of payments and remuneration accrued in his favor (in subsection 6.4);

- the amount of contributions accrued from his payments to the compulsory pension insurance (in subsection 6.5);

- the start and end dates of the individual’s work period for the last 3 months of the reporting/billing period (in subsection 6.8). Based on this information, the Pension Fund of Russia will determine the employee’s length of service (clause 37 of the Procedure for filling out the RSV-1).

Subsection 6.6 of the RSV-1 is filled out only if you need to enter corrective individual information for this employee (clause 35 of the Procedure for filling out the RSV-1). And subsection 6.7 - if you charged contributions at additional rates from employee payments.

The remaining sections in RSV-1 Pension Fund (form)

After you have completed sections 6, proceed to filling out section 1 of the RSV-1 and subsection 2.1. They are both compiled on the basis of the data reflected in sections 6. The information indicated separately for each individual in sections 6 in sections 1 and 2.1 is reflected in general for the policyholder. This indicates the total values of accrued payments and contributions for all employees for each month, in aggregate for the last 3 months of the reporting period, as well as for the period since the beginning of the year on an accrual basis.

Sample of filling out RSV-1 for 2016

You can comment on the instructions for filling out the RSV-1 as much as you like, but it’s always easier to understand the topic using an example. Therefore, using the link below you can download the RSV-1 calculation (sample) for 9 months of 2016.

The Ministry of Health and Social Development, by Order No. 232n dated March 15, 2012, approved the form of calculation for accrued and paid insurance contributions for compulsory pension insurance to the Pension Fund (PFR), insurance contributions to the Federal Compulsory Medical Insurance Fund by insurance premium payers making payments and other remuneration to individuals ( form RSV-1 PFR), and the procedure for filling it out(hereinafter referred to as Order No. 232n).

The new form of calculation for accrued and paid insurance premiums (hereinafter referred to as the Calculation) is applied starting from the submission of reports on insurance premiums for the first quarter of 2012. Previously, the Calculation was submitted in a form approved By order of the Ministry of Health and Social Development of the Russian Federation dated November 12, 2009 No.894n.

The new form has become more detailed; information on accrued insurance premiums for compulsory health insurance is reflected in full, without breaking down the amount accrued and paid to the FFOMS and TFOMS.

Let's look at the procedure for filling out the Calculation form.

General requirements for filling out the Calculation form

Form RSV-1 PFR is filled out using computer technology or a ballpoint (fountain) pen, in black or blue, in block letters.

Payers of insurance premiums (in accordance with the norms Law no.212-FZ autonomous organizations are payers of insurance premiums) submit the PFR form RSV-1 in electronic format with an electronic digital signature, provided that:

- they make payments to individuals;

- the average number of individuals in whose favor payments and other remuneration are made for the previous billing period exceeds 50 people.

In other cases, the PFR form RSV-1 is submitted on paper.

The form is filled out based on accounting data. Only one indicator is entered in each line and its corresponding columns. If there are no indicators provided for in the Calculation, a dash is placed in the line and the corresponding column.

Errors are corrected as follows: the incorrect value of the indicator is crossed out, and the correct value is entered next to it. The correction is signed by the payer or his representative and the date of correction is indicated. All corrections are certified by the organization's seal. Errors may not be corrected by correction or other similar means.

After filling out the Calculation, the completed pages are numbered consecutively in the “Page” field.

Title page , sections 1, 2 Calculations are filled out and submitted by all payers registered with the territorial body of the Pension Fund of the Russian Federation. If more than one tariff was applied during the reporting period, the Calculation includes as many pages of section 2 as the tariffs were applied during the reporting period (regardless of the application of reduced tariffs established for payments accrued in relation to individual employees).

Section 3 Calculations is filled out and submitted by payers applying reduced tariffs in accordance with Art. 58 Law no.212-FZ.

Section 4 Calculations is filled out and submitted by payers who filled out line 120 of section 1 of the Calculation (if additional insurance premiums were charged during the billing period).

Section 5 Calculations filled out and submitted by payer organizations making payments and other remuneration in favor of full-time students in educational institutions of secondary vocational and higher vocational education for activities carried out in a student group (included in the federal or regional register of youth and children's associations receiving state support) under labor or civil law contracts, the subject of which is the performance of work and (or) the provision of services.

At the end of each page of the Calculation, the signature of the payer (successor) or his representative and the date of signing of the Calculation are affixed.

At the top of each completed page of the Calculation, the registration number of the payer is indicated in accordance with the notice (notification) of the policyholder issued during registration (registration) with the Pension Fund of Russia at the place of registration.

Filling out the cover page of the Calculation form

Based on the provisions clause 4,5 Order No.232n, as well as the registration information of the institution, the title page will be filled out as follows. Note that it is filled out by the payer of insurance premiums, with the exception of the section “To be filled out by an employee of the Pension Fund of Russia.”

Field “Registration number of the policyholder in the Pension Fund of Russia”.

When submitting the primary Calculation, zeros (000) are entered in this field.

When submitting a Calculation that reflects changes to the territorial body of the Pension Fund of the Russian Federation (an updated Calculation for the corresponding period), a number is entered indicating which account Calculation, taking into account the changes and additions made, is submitted by the policyholder to the territorial body of the Pension Fund of the Russian Federation (for example: 001, 002, 003... 10, etc.).

The updated Calculation is presented in the form that was in force in the period for which errors (distortions) were identified ( clause 4.1 Calculation).

Field "Reporting period (code)".

The period for which the Calculation is being submitted is indicated. Accordingly, the first quarter is designated by the code 03, the half-year - 06, 9 months - 09, and the Calculation form submitted for the year is designated by the number 12.

Field "Calendar year" - indicate the calendar year for the reporting period of which the Calculation (adjusted calculation) is submitted. In the “Calendar year” field of the Calculation, which reflects the indicators generated for 2012, 2012 is shown.

Field “Name of organization, separate division /F. Acting individual entrepreneur, individual" - the name of the organization is indicated in accordance with the constituent documents (if there is a Latin transcription in the name, one is given) of a separate division.

Field "TIN".

The TIN (taxpayer identification number) is indicated in accordance with the certificate of registration with the tax authority of a legal entity formed in accordance with the legislation of the Russian Federation, at its location in the territory of the Russian Federation. If an autonomous institution has been assigned a 10-digit TIN, a dash should be entered in the last two cells of the zone of 12 cells allocated for recording the TIN indicator.

Field "Checkpoint"

The KPP is indicated (code of the reason for registration at the location of the organization) in accordance with the certificate of registration with the tax authority of a legal entity formed in accordance with the legislation of the Russian Federation, at the location in the territory of the Russian Federation. The checkpoint at the location of the separate subdivision is indicated in accordance with the notification of registration with the tax authority of a legal entity formed in accordance with the legislation of the Russian Federation at the location of the separate subdivision on the territory of the Russian Federation.

Field "OGRN (OGRNIP)".

The main state registration number is indicated in accordance with the certificate of state registration of a legal entity formed in accordance with the legislation of the Russian Federation at its location on the territory of the Russian Federation. When filling out the OGRN of an organization, which consists of 13 characters, a dash is entered in the last two cells of the zone of 15 cells allocated for recording the OGRN indicator.

Field "OKATO Code".

The code of the All-Russian Classifier of Objects of Administrative-Territorial Division is indicated on the basis of an information letter from the state statistics body.

Field "Code according to OKVED" - the code is indicated according to the All-Russian Classifier of Types of Economic Activities OK 029-2001 (NACE Rev. 1) for the main type of economic activity of the payer.

Field "Contact phone number" - indicate the city or mobile phone number of the payer (successor) or the payer’s representative with the city code or mobile operator, respectively. Each cell is filled without using the dash and parenthesis signs.

The fields reserved for the registration address indicate the postal code, locality, district, region, street, house, building - the legal address of the insurance premium payer.

Field “Number of insured persons” - the number of insured persons for whom individual (personalized) accounting information for the reporting period must be provided is indicated.

Field "Average headcount" - indicates the average number of employees, calculated in the manner determined annually by orders of the Federal State Statistics Service.

Information on the number of pages of the submitted Calculation and the number of sheets with supporting documents attached is indicated in the fields “On pages” and “with supporting documents attached or their copies on sheets.”

In the subsection of the title page “I confirm the accuracy and completeness of the information specified in this calculation” in the fields "payer of insurance premiums" , "representative of the insurance premium payer" , "legal successor" the following information is reflected: if the accuracy and completeness of the information is confirmed, the head of the organization enters “1” in the Calculation; if the accuracy and completeness of the information is confirmed by the representative of the insurance premium payer, “2” is entered; in case of confirmation of the accuracy and completeness of the information, the legal successor of the payer of insurance premiums enters “3”.

Field "F. Acting head of the organization" - indicate the full last name, first name, and patronymic of the head of the organization. When submitting a calculation by a representative, the surname, name, patronymic of the representative - an individual, in accordance with the identity document, or the name of the legal entity in accordance with the constituent documents, if the representative of the payer is a legal entity, is indicated in the appropriate field.

In the fields "Signature" , "Date of" the signature of the payer (legal successor) or his representative and the date of signing the Calculation are affixed.

In field “Document confirming the authority of the representative of the insurance premium payer” the type of document confirming the authority of the payer’s representative (legal successor) is indicated.

As can be seen from the information presented above, the title page of the new Calculation form is filled out in the same way as before.

Filling out section 1 “Calculation of accrued and paid insurance premiums”

We propose to consider the procedure for filling out sections 1 and 2 of the Calculation form using a specific example.

At the beginning of the reporting period - 2012, the autonomous institution did not have any overpayment of insurance premiums. In the first quarter, the institution accrued insurance premiums in the following amounts:

| Month | Payment amount | Insurance premiums for compulsory health insurance | Total | ||

| insurance part | accumulative part | ||||

| January | 64 000 | 24 000 | 20 400 | 108 400 | |

| February | 48 000 | 18 000 | 15 300 | 81 300 | |

| March | 72 000 | 27 000 | 22 950 | 121 950 | |

| Total | 184 000 | 69 000 | 58 650 | 311 650 | |

Payment of accrued insurance premiums for March was made on April 10, 2012. The organization employs people born after 1967. There are no disabled people in the organization. The organization is on the general taxation system and applies the basic tariff of insurance premiums (tariff code 01).

Based on the conditions of the example, we will consider the rules for filling out section 1 of the Calculation form.

| Name indicator | Line code | Insurance contributions for compulsory pension insurance | Insurance premiums for compulsory health insurance |

|

| insurance part | accumulative part | |||

| 1 | 2 | 3 | 4 | 5 |

| The balance of insurance premiums payable at the beginning of the billing period (+) debt, (-) overpayment | 100 | - | - | - |

The line “Balance of insurance premiums payable at the beginning of the billing period” is equal to the amount of insurance premiums from line 150 of the Calculation for the previous billing period ( clause 6.1 of Order No.232n).

| Indicator name | Line code | Insurance contributions for compulsory pension insurance | Insurance premiums for compulsory health insurance |

||

| insurance part | accumulative part | ||||

| 1 | 2 | 3 | 4 | 5 | |

| Accrued insurance premiums from the beginning of the billing period | 110 | 184 000 | 69 000 | 58 650 | |

| including for the last three months of the reporting period | 1st month | 111 | 64 000 | 24 000 | 20 400 |

| 2nd month | 112 | 48 000 | 18 000 | 15 300 | |

| 3rd month | 113 | 72 000 | 27 000 | 22 950 | |

| Total payable for the last 3 months | 114 | 184 000 | 69 000 | 58 650 | |

| (line 111 + line 112 + line 113) | |||||

When filling out the form, you should take into account the control ratios (given in clause 6.2 of Order No.232n).

| Line 110 “Insurance premiums accrued from the beginning of the billing period” | = | the sum of the values of line 110 of the Calculation for the previous reporting period of the calendar year and line 114 of the submitted Calculation = the sum of the corresponding data in section 2 (for each tariff code) of the submitted Calculation |

| Line 110 column 3 | = | the sum of the values of lines 250 and 252 of column 3 of section 2 for all tariff codes |

| Line 110 column 4 | = | line 251, column 3, section 2 for all tariff codes |

| Line 110 column 5 | = | line 276, column 3, section 2 for all tariff codes |

| Line 111 column 3 | = | the sum of the values of lines 250 and 252 of column 4 of section 2 for all tariff codes |

| Line 111 column 4 | = | line 251 column 4 section 2 for all tariff codes |

| Line 111 column 5 | = | line 276, column 4, section 2 for all tariff codes |

| Line 112 column 3 | = | the sum of the values of lines 250 and 252 of column 5 of section 2 for all tariff codes |

| Line 112 column 4 | = | line 251, column 5, section 2 for all tariff codes |

| Line 112 column 5 | = | line 276, column 5, section 2 for all tariff codes |

| Line 113 column 3 | = | the sum of the values of lines 250 and 252 of column 6 of section 2 for all tariff codes |

| Line 113 column 4 | = | line 251, column 6, section 2 for all tariff codes |

| Line 113 column 5 | = | line 276, column 6, section 2 for all tariff codes |

| Line 114 | = | sum of row values 111 - 113 corresponding columns |

The amount of additional insurance premiums accrued in the reporting period, both according to inspection reports (desk and (or) on-site), and by the organization independently due to the discovery of the fact of non-reflection or incomplete reflection of information and errors leading to an underestimation of the amount of insurance premiums payable for previous reporting periods, is reflected on line 120 of the Calculation form ( clause 6.3 of Order No.232n). The control relationships of this line with other lines can be found in clause 6.2 of Order No.232n. Since at the very beginning of the comment we stipulated that the procedure for filling out the calculation form will be considered by us through the prism of the given example, and in the example the amount for additional accrual is not provided, we will not dwell on filling out this line.

| Paid from the beginning of the billing period, including | 140 | 112 000 | 42 500 | 35 700 | |

| in the last three months of the reporting period | 1st month | 141 | 64 000 | 24 500 | 20 400 |

| 2nd month | 142 | 48 000 | 18 000 | 15 300 | |

| 3rd month | 143 | - | - | - | |

| total | 144 | 112 000 | 42 500 | 35 700 | |

| (line 141 + line 142 + line 143) | |||||

| for previous billing periods | 145 | - | - | - | |

Note that line 140 “Paid from the beginning of the billing period” reflects the amount of insurance premiums paid from the beginning of the billing period on an accrual basis until the end of the reporting period. The value of this line is calculated as the sum of the values of lines 145 and 144. Line 145 indicates the amounts of insurance premiums paid in the current reporting period for previous billing periods. Since in our example the form is drawn up for the first quarter, a dash is placed on line 145. If the form were compiled for the second quarter, it would reflect the amounts paid by the organization in the first quarter.

The balance of insurance premiums payable at the end of the reporting period is reflected on line 150 and is equal to the difference between lines 130 and 140.

Filling out section 2 “Calculation of insurance premiums by tariff” of the Calculation form

This section of the form reflects information on insurance premiums accrued in the billing period separately in terms of compulsory pension insurance and compulsory medical insurance.

The “Rate code” field indicates the rate code used by the payer in accordance with the rate codes of insurance premium payers in accordance with the appendix to Procedure No. 232n. If more than one tariff was applied during the reporting period, the Calculation includes as many pages of section 2 as the tariffs were applied during the reporting period. In this case, the values of lines 201 - 276 for inclusion in other sections of the Calculation are included as the sum of the values for the corresponding lines for each table of section 2 included in the Calculation.

| Indicator name | Line code | Total from the beginning of the billing period | Including for the last three months of the reporting period | |||

| 1st month | 2nd month | 3rd month | ||||

| The amount of payments and other remuneration accrued in favor of individuals, in accordance with Art. 7 of Law No. 212-FZ and with interstate agreements | Born 1966 and older | 201 | - | - | - | - |

| born 1967 and younger | 202 | 1 150 000 | 400 000 | 300 000 | 450 000 | |

| Foreign citizens and stateless persons temporarily residing/staying on the territory of the Russian Federation | 203 | - | - | - | - | |

Lines 201 - 260 are used to calculate the base for calculating insurance contributions for compulsory pension insurance.

Lines 211 - 213 reflect the amounts of payments and other remuneration that are not subject to insurance premiums in accordance with Law No. 212-FZ and interstate agreements. To simplify the example, we assumed that there were no such payments in the first quarter of 2012.

Lines 231 - 233 reflect the amounts of payments and other remuneration made in favor of individuals for the calculation of insurance premiums, exceeding the maximum base value established annually by the Government of the Russian Federation, in accordance with Part 5 Art. 8 Law no.212-FZ(for each individual it is established in an amount not exceeding 415,000 rubles on an accrual basis from the beginning of the billing period).

The base for calculating insurance contributions for compulsory pension insurance for persons born in 1967 and younger is reflected in line 241.

| Indicator name | Line code | Total from the beginning of the billing period | Including the last three months reporting period |

|||

| 1st month | 2nd | 3rd | ||||

| Base for calculating insurance contributions for compulsory pension insurance | Born 1966 and older (line 201 + line 203 - line 211 - line 213 - line 221 - line 223 - line 231 - line 233) | 240 | 1 150 000 | 400 000 | 300 000 | 450 000 |

| born 1967 and younger (line 202 - line 212 - line 222 - line 232) | 241 | - | - | - | - | |

The value of line 240 is determined by the formula: line 202 minus line 212 minus line 222 minus line 232.

The amount of accrued insurance contributions for pension insurance is reflected in lines 250 - 252.

The values of column 250 “Insurance contributions accrued for compulsory pension insurance - insurance part” are equal to the sum of the values of the corresponding columns of line 240, multiplied by the tariff for a given age group for the insurance part of the pension and the corresponding columns of line 241, multiplied by the tariff for a given age group for the insurance part of the pension.

The values of column 251 “Insurance contributions accrued for compulsory pension insurance - funded part” are equal to the product of the values of the corresponding columns of line 241 and the tariff for a given age group for the funded part of the pension.

The calculation of insurance premiums for compulsory medical insurance is reflected in lines 271 - 276.

Line 271 in the corresponding columns reflects the amounts of payments and other remunerations accrued in favor of individuals in accordance with Art. 7 Law no.212-FZ, as well as with interstate agreements, cumulatively from the beginning of the year and for each of the last three months of the reporting period, subject to insurance premiums for compulsory health insurance.

Line 272 reflects amounts not subject to insurance premiums for compulsory medical insurance in accordance with Part 1, 2 tbsp. 9 Law no.212-FZ and with interstate agreements.

Line 274 reflects the amounts of payments and other remuneration made in favor of individuals for the calculation of insurance premiums, exceeding the maximum base value established annually by the Government of the Russian Federation, in accordance with Part 5 Art. 8 Law no.212-FZ.

Line 275 reflects the base for calculating insurance premiums for compulsory health insurance, which is determined by the formula: line 271 minus line 272 minus line 273 minus line 274.

The values of column line 276 “Insurance premiums accrued for compulsory health insurance” are determined as the product of the values of the corresponding columns of line 275 and the tariff established for the payment of insurance premiums to the Federal Compulsory Health Insurance Fund.

Filling out subsection 3.6 “Calculation of compliance of conditions for the right to apply a reduced tariff for payment of insurance premiums by insurance premium payers specified in paragraph 8 of part 1 of Article 58 of the Federal Law of July 24, 2009 No. 212-FZ” of the Calculation form

This section of the form is filled out by autonomous organizations that apply the simplified tax system and use reduced tariffs when calculating insurance premiums.

Line 361 indicates the total amount of income determined in accordance with Art. 346.15 Tax Code of the Russian Federation cumulatively from the beginning of the reporting (calculation) period.

Line 362 indicates the amount of income from the sale of products and (or) provision of services in the main type of economic activity.

The indicator of line 363 is calculated as the ratio of the values of lines 362 and 361, multiplied by 100.

Filling out section 4 “Amounts of additionally accrued insurance premiums from the beginning of the billing period” of the Calculation form

The section is filled out by payers who have accrued additional insurance premiums in the current reporting period for previous reporting (calculation) periods.

The table indicates the year, month and amount of additionally accrued insurance premiums for inspection reports (desk and (or) on-site) for which decisions to bring into liability came into force in the current reporting period.

In addition, in case of independent identification of the fact of non-reflection or incomplete reflection of information, as well as errors leading to an underestimation of the amount of insurance premiums payable for previous reporting periods, the payer can reflect the amounts of independently accrued insurance premiums.

Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund.”

Today, an individual entrepreneur, as well as a legal entity, is required to provide to the Pension Fund (its territorial branch) not only individual information, but also a certificate in the RSV-1 form.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

This document contains a fairly large amount of information, the transfer of which is strictly required not only to the Pension Fund of the Russian Federation, but also to the Compulsory Medical Insurance Fund.

It is imperative to comply with the deadlines for submitting this document. Otherwise, the enterprise (or individual entrepreneur) will be fined - in accordance with the legislation in force in the Russian Federation.

Basic information

RSV-1 is a very important document. Any entrepreneur or head of an organization, regardless of the type of tax regime used, should be sure to familiarize themselves with all the basic provisions and information regarding this certificate.

This will avoid many problems, as well as unnecessary attention from the Federal Tax Service. Basic information you need to know:

- definitions;

- who should take the test;

- normative base.

Definitions

All kinds of concepts and definitions relating to are displayed in various regulatory documents, as well as current legislation.

This abbreviation has the following definition: “calculation of accrued and paid insurance premiums.” Moreover, contributions to the following funds are taken into account:

This document displays all amounts that were allocated for the following purposes:

The duration of the billing period for DAM-1 is 12 calendar months. The duration of the reporting periods is 12, 9, 6, 3 months.

In this case, this document must be submitted quarterly. All information is received on a cumulative basis from the very beginning of the calendar year.

The legislation defines the following deadlines for filing RSV-1:

If the organization was created in the middle of the year, then RSV-1 is also required to be submitted to it.

This must be done after the end of the quarter in which it was registered and began to conduct commercial activities and make contributions for individuals to the relevant funds.

Who should take it?

The list of organizations, as well as persons obligated to take the RSV-1, is announced in the legislation of the Russian Federation.

Thus, this document is required to be submitted to the Pension Fund of the Russian Federation within the established time frame:

Normative base

The regulatory framework relating to the document in the RSV-1 form is quite extensive. It includes the following:

- – this PP determines the amount of the amount, taking into account which insurance premiums are formed (for 2019, the amount was 624,000 rubles).

Over time, various amendments have been made to the regulatory framework. Most of them were included precisely in Federal Law No. 333 of December 2, 2013:

There is one important nuance - reduced tariffs apply only to certain types of activities and organizations:

- charitable;

- pharmacy;

- Individual entrepreneurs applying the patent taxation system.

However, the reduced rate can only be used until 2019. Also, the regulatory framework regarding RSV-1 should include:

| Some amendments have been made to the laws - | |

| Amendments have been made to laws No. 212-FZ, |

Pension legislation will soon be subject to reform. The most important change that will affect everyone (individual entrepreneurs and legal entities) is that it will be necessary to submit monthly RSV-1 calculations to the Pension Fund of the Russian Federation.

The innovation is necessary to track the wages of workers by age or who have retired due to other circumstances.

In the future, the Ministry of Labor plans to refuse pension payments to working pensioners at a certain salary level.

Existing submission methods

Certificate RSV-1 can be submitted:

- in electronic form;

- on paper.

There is one important nuance regarding the submission of this reporting. In paper form, filing RSV-1 is possible only if the company (or individual entrepreneur) has less than 25 people.

If this limit is exceeded, then it is necessary to create an electronic version of the document.

But even if the document is not submitted through a special system created for the circulation of important documents between government agencies and enterprises, the submitter is required to submit to the relevant authorities not only two printed paper copies of the RSV-1, but also an electronic document on a flash card.

Therefore, it is best to prepare everything you need in advance and perform the required calculations on a personal computer via Word or Excel.

There are also some differences regarding the place where this paper must be submitted. RSV-1 should be submitted:

If the enterprise is a structural division of a larger company and has its own balance sheet and current account, then they submit RSV-1 at the place of their actual location.

Check your report online

The formation of RSV-1 is not so simple. It is for this reason that a large number of different specialized resources have appeared on the Internet, allowing you to use various programs to check whether the form has been filled out correctly.

The most commonly used applications for this are:

- CheckXML.

- CheckXML-UFA.

Moreover, most of the resources use only current programs; the use of outdated ones is excluded.

If during the testing process any error was discovered in a document uploaded to the site, specialists collaborating with the resource will be able to help make all the necessary corrections - while confidentiality is guaranteed.

Video: insurance contributions to funds (PFR, Social Insurance Fund, Compulsory Medical Insurance)

Specialists from the Pension Fund of Russia, the Social Insurance Fund and the Federal Tax Service took part in the development of many such online verification tools. You should look for confirmation of this on the pages of the site.

Penalty for late provision of RSV-1

The legislation on the territory of the Russian Federation provides for a fine for failure to submit the RSV-1 form on time. Its size is not very large.

However, you should not miss reporting deadlines, since failure to submit calculations on time can lead to quite serious problems with the tax authorities.

For example, the Federal Tax Service may initiate a desk audit, perceiving failure to submit RSV-1 as an attempt by the enterprise to hide its income from the state.

Fines for failure to submit the RSV-1 form are as follows:

Legislative reforms also affected fines. Thus, from 2019, personalized accounting information must be included in the calculation of the form of the type in question.

For the absence of this information in the reporting documentation, a fine is again imposed, separately. Its size is 5% of the amount of contributions that were accrued over the last three months of the reporting period.

An important nuance regarding this fine is the absence of a minimum and maximum amount. This is very important to remember, as sometimes the amount may simply be unaffordable.

Therefore, it is best to provide the relevant authorities with all the required information in a timely manner. This will avoid serious financial losses.

At the same time, the Ministry of Labor prohibits penalties for one violation more than once. But there is no judicial practice regarding this situation.

Therefore, it is not yet clear how the territorial branches of the Pension Fund will behave in the presence of such fines.

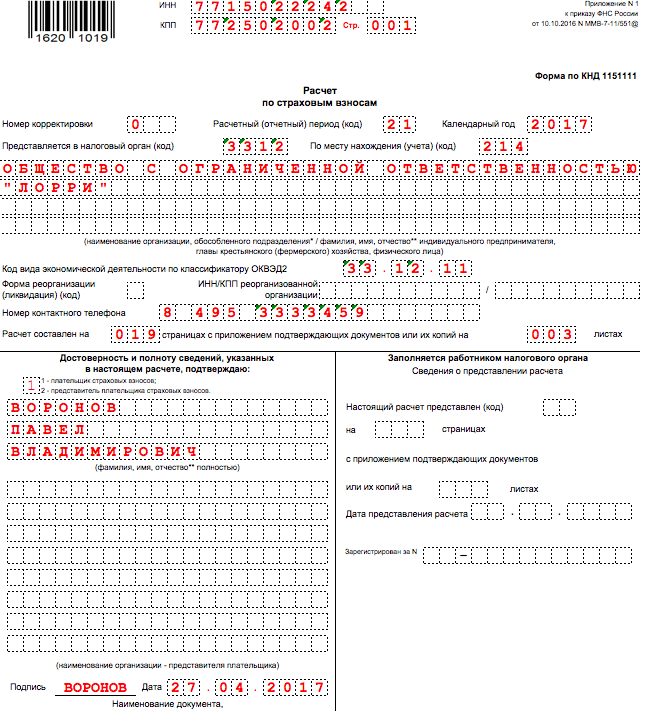

All organizations and individual entrepreneurs (insurers) will have to fill out a new calculation of insurance premiums (DAM) for the first quarter of 2017 for the first time. How to create a new calculation? When should I submit it to the Federal Tax Service? How to report to organizations using the simplified tax system that apply reduced insurance premium rates? This article provides instructions for filling out a new calculation for insurance premiums, and also contains a sample DAM for the 1st quarter of 2017 filled out using a specific example.

Changes in reporting on insurance premiums since 2017

Since 2017, employers have faced serious changes: pension, medical, and contributions in case of disability and in connection with maternity (except for contributions for injuries) moved from the Pension Fund of the Russian Federation under the control of the Federal Tax Service. In connection with this, Federal Tax Service Order No. ММВ-7-11/551 dated 10.10.2016 approved a new form for calculating insurance premiums, which must be presented to the Federal Tax Service to all enterprises, regardless of their legal form and owners of their own business (IP) who have workers.

The new unified calculation of insurance premiums is a document that simultaneously replaced the calculations of RSV-1, 4-FSS, RSV-2 and RV-3. Tax officials identify three main purposes for which new reporting has been introduced:

- reducing the administrative burden on business by reducing the number of regulatory authorities;

- reporting optimization;

- improving the quality of inspections.

You can learn more about changes in reporting since 2017 from our materials: “”, “”.

Methods and deadlines for submitting a new calculation

A new reporting document must be submitted to the territorial tax service. You can do this in two ways:

The deadline for submitting a new calculation for insurance premiums in 2017 is until the 30th day of the month following the reporting period:

In 2016, the method of submitting calculations for insurance premiums (RSV-1) influenced the acceptable deadline for submitting reports. Those who report electronically had 5 more days to submit the RSV-1. Thus, legislators apparently encouraged employers to switch to electronic reporting. But in 2017 there is no such approach. A single deadline has been determined for all taxpayers: calculations for insurance premiums are submitted by all until the 30th day of the month following the reporting period.

Composition of calculations for insurance premiums

The composition of the calculation of insurance premiums in 2017 is as follows:

- title page;

- sheet for persons who do not have the status of an individual entrepreneur;

- Section No. 1, which includes 10 applications;

- Section No. 2, supplemented by one appendix;

- Section No. 3 – contains personal information about the persons for whom the policyholder makes contributions.

At first it may seem that the new calculation of insurance premiums is very large - there are 10 annexes to section 1 alone! However, there is no need to be afraid. It is not necessary to fill out and submit all sections and applications as part of the calculation of insurance premiums for the 1st quarter of 2017. The table below will help you figure out exactly which sections of the new calculation need to be generated and submitted to the inspection:

Which sections of the insurance premium calculation should be filled out? Calculation sheet (or section) Who makes up Title page All policyholders Sheet “Information about an individual who is not an individual entrepreneur” Individuals who are not individual entrepreneurs, if they did not indicate their TIN in the calculation Section 1, subsections 1.1 and 1.2 of appendices 1 and 2 to section 1, section 3 All organizations and individual entrepreneurs that paid income to individuals in the 1st quarter of 2017 Section 2 and Appendix 1 to Section 2 Heads of peasant farms Subsections 1.3.1, 1.3.2, 1.4 of Appendix 1 to Section 1 Organizations and individual entrepreneurs transferring insurance premiums at additional rates Appendices 5 - 8 to section 1 Organizations and individual entrepreneurs applying reduced tariffs (for example, conducting preferential activities on the simplified tax system) Appendix 9 to section 1 Organizations and individual entrepreneurs that paid income to foreign employees or stateless employees temporarily staying in the Russian Federation in the 1st quarter of 2017 Appendix 10 to section 1 Organizations and individual entrepreneurs that paid income to students working in student teams in the 1st quarter of 2017 Appendices 3 and 4 to section 1 Organizations and individual entrepreneurs that paid hospital benefits, child benefits, etc. in the 1st quarter of 2017 (that is, related to compensation from the Social Insurance Fund or payments from the federal budget) Filling out the calculation of insurance premiums for the 1st quarter of 2017: rules

When drawing up a single calculation of insurance premiums for the 1st quarter of 2017, use the insurance premiums card, which reflects payments and rewards accrued and paid to individuals in 2017. See "".

Taking into account the list of non-taxable payments presented in Article 422 of the Tax Code of the Russian Federation, the accountant should, in particular, determine the base of insurance premiums and perform the necessary calculations. The results are entered into the corresponding calculation fields. Cm. " ".

As we have already said, you need to fill out the calculation of insurance premiums in 2017 using the form approved by the Order of the Federal Tax Service of October 10, 2016 No. ММВ-7-11/551 () in compliance with 7 fundamental rules, which are approved by the same document:

- each field is intended for a specific indicator and cannot be supplemented with other information;

- pages are formatted in the corresponding cells in this way: “001”, “002”... “033”;

- for a decimal fraction, two fields are allocated: the first contains the whole part, and the second contains the remainder;

- text fields are filled in from left to right, starting from the first window;

- cost indicators are indicated in rubles and kopecks, separated by a dot;

- when filling out a document on a computer, use the Courier New font (16-18 point);

- In the fields for quantitative and total indicators, put “0” (“zero”). In other cases, for example, when there are no text indicators, put a dash in all character spaces in the field. However, when filling out the calculation on a computer, you do not need to put zeros and dashes in the empty cells.

Now let’s look at the procedure for filling out each section and appendices using examples of generating calculations for insurance premiums for the 1st quarter of 2017.

Title page

The title page contains fields intended to be filled out by the payer and the tax authority employee. The accountant of an organization or individual entrepreneur enters information in the following lines:

TIN and checkpoint

Taxpayer identification number - indicate in accordance with the certificate of registration with the Federal Tax Service of a legal entity, individual entrepreneur or individual. Organizations are assigned a 10-digit code, so put a dash in the last two cells (if you are generating a report “on paper”):

Meaning of checkpoint - write in accordance with the legal entity registration document. Individual entrepreneurs put dashes in the “Checkpoint” field (or leave it blank if the calculation is filled out on a computer for submission electronically).

Correction number

Place the adjustment number on the title page of the calculation for the 1st quarter of 2017 only when submitting a clarifying calculation. If you are filling out the document and submitting it to the tax office for the first time, then indicate the mark “0 – -”.

Settlement (reporting) period

In this field on the title page, enter a code that characterizes the specific period of time for which reporting is submitted. When calculating for the 1st quarter of 2017, enter code 21.

Federal Tax Service code

In this field, you need to mark the code of the Federal Tax Service to which you are submitting reports for the 1st quarter of 2017. You can find out the value for a specific region on the Federal Tax Service website using the official service.

Place of provision code

As this code, show a digital value indicating the ownership of the Federal Tax Service to which the DAM is submitted for the 1st quarter of 2017. The codes used are presented in the table:

Name

Indicate the name of the organization or full name of the individual entrepreneur on the title page in accordance with the documents, without abbreviations. Leave one free cell between words.

Form of reorganization or liquidation

The meaning of this field depends on the specific situation in which the organization finds itself. The following values can be accepted:

OKVED codes

In the field “Code of the type of economic activity according to the OKVED2 classifier”, indicate the code according to the All-Russian Classifier of Types of Economic Activities. You cannot enter “old” OKVED codes in the DAM calculation for the 1st quarter of 2017.

Reliability and completeness of information

Confirmation of the accuracy and completeness of information in the calculation of insurance premiums for the 1st quarter of 2017 - this information is necessary for tax authorities. In the special fields on the title page, write down the name of the policyholder, indicate the date of the calculation and sign. If the calculation is submitted by a representative, then an additional copy of documentary evidence of authority should be attached to the reporting. Most likely, no questions will arise with the design of the remaining cells of the title page. But if in doubt, refer to the completed sample:

Sheet “Information about an individual who is not an individual entrepreneur”

The sheet “Information about an individual who is not an individual entrepreneur” comes after the title page. It must be generated by individuals who submit calculations for insurance premiums for the 1st quarter of 2017 for hired workers and who did not indicate their TIN in the calculation. Then on this sheet the employer must show his personal data (in particular, full name, date and place of birth and passport details). This sheet looks like this:

Please keep in mind that the sheet “Information about an individual who is not an individual entrepreneur” does not apply to organizations and individual entrepreneurs. As part of the calculation of insurance premiums for the 1st quarter of 2017, they do not fill it out and do not submit it.

Section 1: Premium Summary

In section 1 of the calculation for the 1st quarter of 2017, reflect the general indicators for the amounts of insurance premiums payable. The part of the document in question consists of lines from 010 to 123 (two sheets), which indicate OKTMO, the amount of pension and medical contributions, contributions for temporary disability insurance and other deductions.

For example, you will fill out line 030 of section 1 in relation to pension contributions during 2017 on an accrual basis, and lines 031-033 - in relation to the months of the reporting period. The calculation for the 1st quarter on lines 031-033 should include the amounts of insurance premiums for January, February and March 2017. A similar approach applies to other types of insurance premiums included in Section 1.

On lines 120-123 of section 1, display the amounts exceeding the insurer's costs for benefits over the calculated insurance premiums for temporary disability and maternity. If there was no excess, then leave these lines empty. A sample of section 1 of the calculation of insurance premiums for the 1st quarter of 2017 is shown in the figure:

For each type of insurance premium in the first section of the calculation for the 1st quarter of 2017, the BCC must be shown in separate fields. The classification of budget classification codes allows Federal Tax Service employees to correctly record cash receipts in the personal account of a company or individual entrepreneur. You indicated to KBK in your payment orders the payment of insurance premiums for January, February and March 2017. Now transfer them to the calculation of insurance premiums for the first quarter of 2017. Cm. " ".

Appendix 1: calculation of pension and medical contributions

In Appendix 1 to Section 1, reflect the calculation of insurance premiums for pension and health insurance, as well as the number of insured persons for whose payments contributions were accrued. This application consists of four subsections:

- subsection 1.1 “Calculation of the amounts of insurance contributions for compulsory pension insurance”;

- subsection 1.2 “Calculation of insurance premiums for compulsory health insurance”;

- subsection 1.3 “Calculation of the amounts of insurance contributions for compulsory pension insurance at an additional rate for certain categories of insurance premium payers specified in Article 428 of the Tax Code of the Russian Federation”;

- subsection 1.4 “Calculation of the amounts of insurance contributions for additional social security of flight crew members of civil aviation aircraft, as well as for certain categories of employees of coal industry organizations.”

The first two subsections are required to be completed by all persons providing calculations of insurance premiums in 2017. Form the indicators of subsections 1.1 and 1.2 from the beginning of 2017. Where necessary: make a “breakdown” for January, February and March 2017. Let's look at the features of filling out the main fields of these sections and provide examples.

Subsection 1.1: pension contributions

In subsection 1.1 of Appendix 1 to Section 1, include data on the calculation of the taxable base and the amount of insurance contributions for compulsory pension insurance. Also indicate the possible payer tariff code:

We will explain the features of filling out the main lines of this section as part of the calculation of insurance premiums for the 1st quarter of 2017 in the table and add a sample:

Filling out the lines of subsection 1.1 Subsection line 1.1 Filling 010 The total number of insured persons under compulsory pension insurance since the beginning of 2017 (broken down by January, February and March). 020 The number of individuals from whose payments you calculated pension insurance contributions from January 1, 2017 to March 31, 2017. 021 The number of individuals from line 020 whose payments exceeded the maximum base for calculating pension contributions. In 2017, this amount was 876,000 rubles (See “”). 030 Amounts of accrued payments and rewards in favor of individuals in the period from January to March 2017 (inclusive). This refers to payments that are subject to insurance premiums (clauses 1 and 2 of Article 420 of the Tax Code of the Russian Federation). 040 Amounts of payments not subject to insurance contributions for compulsory pension insurance (Article 422 of the Tax Code of the Russian Federation); 050 Base for calculating pension contributions in the 1st quarter of 2017. 051 The base for calculating pension insurance contributions in amounts that exceed the maximum base value for each insured person: 876,000 rubles (clauses 3–6 of Article 421 of the Tax Code of the Russian Federation). 060 (including 61 and 62) Amounts of calculated pension contributions, in particular:

- on line 061 - from a base not exceeding 876,000 rubles;

- on line 062 – from a base exceeding 876,000 rubles.

Subsection 1.2: medical contributions

Subsection 1.2 of Appendix 1 to Section 1 should include the calculation of the taxable base and the amount of insurance premiums for compulsory health insurance. We will explain the procedure for filling out the lines of this subsection as part of the calculation for the 1st quarter of 2017 in the table and give an example of filling:

Filling out the lines of subsection 1.2 Subsection line 1.2 Filling 010 Total number of insured people in the health insurance system since the beginning of 2017. 020 The number of individuals from whose payments you have calculated insurance premiums since the beginning of 2017. 030 Amounts of payments in favor of individuals from January to March 2017 (inclusive). 040 Amounts of payments that are not subject to insurance premiums for compulsory health insurance (Article 422 of the Tax Code of the Russian Federation). 050 The basis for calculating contributions for health insurance (clause 1 of Article 421 of the Tax Code of the Russian Federation). 060 Amounts of calculated “medical” contributions.

The remaining sections of Appendix No. 1 are completed in the case of deduction of insurance premiums at additional rates provided for certain categories of insurance premium payers. However, within the scope of this article we will not consider filling them out.

Appendix 2: calculation of contributions for disability and maternity

In Appendix 2 to Section 1 of the calculation for the 1st quarter of 2017, describe the calculation of the amounts of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity. Since 2017, these contributions have also been controlled by the Federal Tax Service.

In field 001 of Appendix 2, indicate the code for insurance payments for compulsory social insurance in case of temporary disability and in connection with maternity, namely:

- “1” – if direct payments of insurance coverage are made from the Social Insurance Fund budget (if a Social Insurance Fund pilot project has been implemented in the region, see “ ”);

- “2” – if benefits are paid by employers, and then the costs are counted against the payment of insurance premiums.

Let's decipher the order of filling out the remaining lines of this section and give a sample:

Filling application lines 2 Application line 2 Filling 010 Total number of insured employees since the beginning of 2017. 020 Amounts of payments to employees from January to March 2017 (inclusive). 030 Amounts of payments not subject to insurance contributions for compulsory social insurance (Article 422 of the Tax Code of the Russian Federation). 040 Amounts of payments and other remuneration in favor of individuals who are subject to social insurance contributions and exceed the limit for the next year (in 2017 these are payments in excess of 755,000 rubles for each person). Cm. " "). 050 The basis for calculating insurance contributions for compulsory social insurance, formed from January 1 to March 31, 2017. 051 The indicator in this line must be entered by companies or individual entrepreneurs that have a license for pharmaceutical activities and apply UTII. In this line, they should record the basis for calculating insurance premiums in terms of payments in favor of employees who have the right to engage in pharmaceutical activities or are admitted to it. 052 This line must be filled out by companies making payments to crew members of ships registered in the Russian International Register of Ships in 2017. In this line you need to record the basis for calculating insurance premiums in terms of payments to crew members (subclause 4, clause 1, article 427 of the Tax Code of the Russian Federation). 053 This line is filled out only by individual entrepreneurs who apply the patent taxation system (with the exception of individual entrepreneurs whose leading activities are specified in subclause 19, 45–48 clause 2 of Article 346.43 of the Tax Code of the Russian Federation), who make payments to employees (subclause 9 clause 1 of Art. 427 Tax Code of the Russian Federation). Using this line, they need to fix the basis for calculating insurance premiums in terms of payments to employees under employment contracts. 054 This line is for organizations and private businessmen paying income to foreign employees temporarily staying in Russia. Using this line, they need to show the basis for calculating insurance premiums in terms of payments in favor of such employees. The exception is citizens of countries from the EAEU. They do not belong to this line. 060 Amounts of calculated insurance contributions for compulsory social insurance for the 1st quarter of 2017. 070 Amounts of expenses for payment of insurance coverage for compulsory social insurance (sick leave, maternity benefits, etc.). 080 Amounts that in the first quarter of 2017 an organization or individual entrepreneur received from the Social Insurance Fund in the form of reimbursement of expenses (for sick leave, maternity benefits, etc.). 090 The amount of insurance premiums payable for each month of the 1st quarter of 2017.

If the amount of contributions to be paid is obtained, then in line 090 enter code “1” (that is, if the contributions turned out to be more than the cost of benefits). If the amount of benefit expenses exceeded the amount of accrued contributions, then reflect code “2” on line 090.

Appendix 3: Benefit Costs

In Appendix 3 to Section 1 of the calculation for the 1st quarter of 2017, indicate information on expenses for the purposes of compulsory social insurance. We are talking about the following types of insurance payments made during the period from January 1 to March 31, 2017:

- temporary disability benefits;

- maternity benefits;

- a one-time benefit for women who registered with medical organizations in the early stages of pregnancy;

- lump sum benefit for the birth of a child;

- monthly child care allowance

- payment for additional days off to care for disabled children;

- social benefit for funeral or reimbursement of the cost of a guaranteed list of funeral services.

If such benefits were not paid in the 1st quarter of 2017, then do not fill out Appendix 3 and do not submit it as part of the calculation for the 1st quarter of 2017. If payments have taken place, then follow the following filling procedure:

- on lines 010 - 090 - show for each type of payment the number of cases of payment, the number of days paid, as well as the amount of expenses incurred (including those financed from the federal budget);

- on line 100 - record the total amount of expenses for the named payments (including those financed from the federal budget).

Let’s assume that in the 1st quarter of 2017, sickness benefits were paid to four employees. The total number of payment days is 16 days. The total amount is 7,500 rubles (including the first three days of illness). Then an example of completed application 3 would be like this:

Appendix 4: budget benefits

In Appendix 4 to Section 1 of the calculation for the 1st quarter of 2017, reflect information about benefits financed from the federal budget:

- on lines 010–060 – payments to Chernobyl victims;

- on lines 070–120 – benefits to victims of the accident at Mayak Production Association;

- on lines 130–140 – payments to citizens injured as a result of tests at the Semipalatinsk test site;

- on lines 150–200 – cash transfers to citizens who have suffered radiation sickness;

- on lines 210–230 - information about benefits related to the inclusion in the insurance record of the insured person of periods of service during which the citizen was not subject to compulsory social insurance (Part 4 of Article 3 of Law No. 255-FZ of December 29, 2006).

In lines 240–310 reflect the totals. If the above payments were not made, then do not create Appendix 4 and do not submit the reporting for the 1st quarter to the Federal Tax Service.

Appendix 5: for IT organizations

Appendix 5 of Section 1 of the calculation for the 1st quarter of 2017 is required to be generated only by IT organizations that:

- develop and implement their own computer programs or databases, perform work and provide services for the development, adaptation, modification, installation, testing and maintenance of computer programs and databases;

- received a certificate of state accreditation as an organization operating in the field of IT;

- have an average number of employees of at least seven people;

- receive income from activities in the field of IT technologies: at least 90 percent of all their income.

The named IT companies have the right to pay insurance premiums at reduced rates (subclause 3, clause 1, clause 5, article 427 of the Tax Code of the Russian Federation). It is worth noting that if an IT company was created recently and there is no data for 9 months of 2016 yet (from January to September inclusive), then as part of the calculation for the 1st quarter of 2017 they need to show information only in column 3 of Appendix 5 .

If you are interested in filling out Appendix 5 in more detail, you may suggest relying on the following transcripts and sample:

Appendix 5: for IT organizations Application line 5 Filling 010 Average number of employees for 9 months of 2016 and at the end of the first quarter of 2017. 020 The total amount of income determined according to the rules of Article 248 of the Tax Code of the Russian Federation (for 9 months of 2016 and based on the results of the first quarter of 2017). 030 The amount of income from activities in the field of information technology (for 9 months of 2016 and based on the results of the first quarter of 2017). 040 The share of income from activities in the IT field in the total amount of income (for 9 months of 2016 and based on the results of the first quarter of 2017). 050 The date and number of the entry in the register of accredited organizations operating in the field of IT (from the IT register of the Ministry of Telecom and Mass Communications of Russia).

On line 040 of Appendix 5, reflect the share of income from IT activities in the total amount of income. Calculate the share using the formula: line 40 = line 30 / line 20 x 100%.

Appendix 6: for “simplers” at reduced tariffs

Appendix 6 of Section 1 of the calculation for the 1st quarter of 2017 must be completed:

- organizations or individual entrepreneurs on the simplified tax system, engaged in the social or industrial sphere and entitled to a reduced contribution rate (subclause 5, clause 1, subclause 3, clause 2, article 427 of the Tax Code of the Russian Federation);

- individual entrepreneurs combining the simplified tax system and the patent taxation system (PTS).

On line 060 of Appendix 6, note the total amount of income under the simplified tax system from January 1 to March 31, 2017, and on line 070, highlight income exclusively from the main type of activity under the simplified tax system (subclause 3, clause 2, article 427 of the Tax Code of the Russian Federation). On line 080, record the share of income from the main activity according to the simplified tax system. You can determine this share using the following formula:

Formula for calculating the share of income under the simplified tax system

For income from the main activity on the simplified tax system = line 070 / line 060 ×100%

Appendix 7: non-profit organizations on the simplified tax system

Appendix 7 of Section 1 of the calculation for the 1st quarter of 2017 is required to be formed by non-profit organizations on the simplified tax system operating in the field of social services for the population, scientific research and development, education, healthcare, culture and art and mass sports. Such companies also have the right to use reduced insurance premium rates (subclause 3, clause 2, article 427, clause 7, article 427 of the Tax Code of the Russian Federation).

Appendix 8: IP on the patent system

Appendix 8 of Section 1 of the calculation for the 1st quarter of 2017 applies only to individual entrepreneurs on the patent tax system. An exception is individual entrepreneurs on a patent engaged in the following business (subclause 19, 45–48 clause 2 of article 346.43 of the Tax Code of the Russian Federation):

- leasing of real estate owned by them;

- retail trade through trading floors or retail locations;

- catering services.

In Appendix 8, fill out the number of lines 020–060 equal to the number of patents the individual entrepreneur received in 2017. Let us explain the procedure for filling out and deciphering the lines of this application and introduce an example of filling out:

Appendix 8: IP on the patent system Application line 8 Filling 010 The total amount of payments within the framework of activities in 2017 for all patents. 020 The number of the patent issued to the businessman. 030 Code of the type of business activity from the patent application. 040 Patent start date. 050 Patent expiration date. 060 Amounts of payments to employees under employment contracts since the beginning of 2017: for January, February and March 2017.

Appendix 9: data on foreigners

In Appendix 9 of Section 1 of the calculation for the 1st quarter of 2017, show data on foreigners temporarily staying in the Russian Federation. However, do not get confused: information about foreigners - highly qualified specialists, as well as citizens of states from the EAEU should not be reflected in this application.

Using lines 020 – 080 of Appendix 9, record information on all foreigners whose payments were subject to insurance premiums in the 1st quarter of 2017. Provide information about such foreigners:

- lines 020–040 – full name;

- line 050 – TIN;

- line 060 – SNILS;

- line 070 – country of citizenship code.

Appendix 10: payments to students

Fill out Appendix 10 of Section 1 of the calculation for the 1st quarter of 2017 if you paid income to students who worked from January to March 2017 in student groups. These payments are shown separately because they are not subject to pension contributions. However, we note that for this the conditions given in subparagraph 1 of paragraph 3 of Article 422 of the Tax Code of the Russian Federation must be met. If such a benefit is available, then attach to the calculation of insurance premiums for the 1st quarter of 2017 and submit to the Federal Tax Service:

- student's certificate of membership in the student group;

- a certificate from the educational institution about the form of study.

Section 2: heads of peasant farms

Section 2 of the calculation of insurance premiums for the 1st quarter of 2017 should be completed only for the heads of peasant (farm) households. This section is a set of indicators about the amounts of insurance premiums payable to the budget for them. Here's what information you need to enter in this section:

Appendix 1: calculation of the amounts of contributions for the head and members of the peasant farm

In Appendix 1 to Section 2 of the calculation of insurance premiums for the 1st quarter of 2017, show information personally for each member of the peasant farm, namely:

- in lines from 010 to 030 - full name;

- in line 040 – TIN;

- in line 050 – SNILS;

- in line 060 – year of birth;

- in line 070 – the date of joining the peasant farm in 2017 (if the joining took place from January to March inclusive);

- in line 080 - the date of exit from the peasant farm in 2017 (if the exit took place from January to March inclusive).

- in line 090 – the amount of insurance premiums payable to the budget for each member of the peasant farm based on the results of the 1st quarter of 2017.

Section 3: personalized information about each employee

This section is intended to reflect individuals who receive income subject to insurance premiums. Additional sections allow you to correctly distribute all the information. Let's look at them in more detail.

Start of sheet 3

On line 010 of the initial calculation of insurance premiums for the 1st quarter of 2017, enter “0–”. If you adjust data for the 1st quarter, then in the updated calculation you will need to indicate the adjustment number (for example, “1–”, “2–”, etc.).

In field 020 of sheet 3, show the code of the billing (reporting) period. The first quarter corresponds to the code “21”. In field 030, indicate the year for the billing (reporting) period of which information is being provided – “2017”.

In field 040, reflect the serial number of the information. And in field 050 - the date of presentation. Here's an example:

Subsection 3.1: who received the income

In subsection 3.1 of the calculation, indicate the personal data of the employee to whom the organization or individual entrepreneur issued payments or rewards. The explanation of filling out the lines and a sample are given below:

Lines of subsection 3.1 Filling Filling 060 TIN 070 SNILS 080, 090 and 100 Full name 110 Date of Birth 120 Code of the country of which the individual is a citizen 130 Gender code: “1” – male, “2” – female 140 Identity document type code 150 Details of the identity document (for example, passport series and number) 160, 170 and 180 Sign of an insured person in the system of compulsory pension, medical and social insurance: “1” – is an insured person, “2” – is not an insured person

Subsection 3.2: payments and pension contributions

Subsection 3.2 as part of the calculation must contain information:

- on payments in favor of individuals (for example, employees);

- on accrued insurance contributions for compulsory pension insurance.

In this subsection, you will be faced with the need to fill out the columns of subsection 3.2.1, indicated in the table:

Subsection graphs 3.2.1 Filling 190 The serial number of the month in the calendar year (“01”, “02”, “03”, “04”, “05”, etc.) for the first, second and third month of the last three months of the billing (reporting) period, respectively. That is, in calculations for the 1st quarter of 2017, you need to show: 01, 02 and 03 (January, February and March). 200 Category code of the insured person (from Appendix 8 to the Procedure for filling out calculations for insurance premiums, approved by Order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/551). The code for employees under employment contracts is HP. 210 The amount of payments to employees for January, February and March 2017. 220 The base for calculating pension contributions does not exceed the maximum value - 876,000 rubles. 230 Amount of payments under civil contracts. 340 Amount of insurance premiums 250 The total amount of payments in favor of the employee, not exceeding the limit value - 876,000 rubles.

Also included in subsection 3.2 is another subsection 3.2.2. It needs to record payments from which pension contributions are calculated at additional rates. This subsection might look like this:

Responsibility: what threatens

For late submission of the calculation of insurance premiums for the 1st quarter of 2017 on time, the Federal Tax Service has the right to hold the company or individual entrepreneur accountable in the form of a fine. The amount of the fine is 5 percent of the amount of insurance premiums payable (additional payment) based on the calculation for the 1st quarter. However, keep in mind that when calculating this fine, tax authorities will remove the amount of contributions that the organization or individual entrepreneur transferred on time. A 5 percent fine will be charged for each month (full or partial) of delay in submitting the calculation. In this case, the total amount of the fine cannot be more than 30 percent of the amount of contributions and less than 1,000 rubles. That is, if contributions for the entire 1st quarter of 2017 were paid on time, then the fine for being late in submitting the calculation will be only 1,000 rubles. If only part of the contributions is paid within the prescribed period, then the fine will be calculated from the difference between the amount of contributions indicated in the calculation and actually transferred to the budget (Article 119 of the Tax Code of the Russian Federation).

If the calculation for the 1st quarter of 2017 is submitted to the Federal Tax Service on time, but there are discrepancies between the total amount of insurance premiums and the amount of contributions for each employee, then the reporting will be considered not submitted at all. After receiving a notification from the Federal Tax Service, you will need to make corrections to the calculation within five working days. And then the date of submission of the calculation will be considered the date when you submitted it for the first time (paragraphs 2 and 3, paragraph 7 of Article 431 of the Tax Code of the Russian Federation).

Keep in mind that timely failure to submit a single calculation of insurance premiums to the tax authority does not serve as a basis for suspending transactions on the insurance premium payer’s bank accounts. See “Accounts will not be blocked for insurance premiums.”.html

A mistake was made: what to do

When preparing reports, there remains a risk of entering data incorrectly. What the policyholder should do in such a situation depends on the consequences:

- A mistake made has reduced the amount of the payment - it is necessary to submit a “clarification” to the Federal Tax Service, which includes incorrectly filled out pages and section 3. Other sheets are attached only if it is necessary to make additions.

- Incorrect information did not change the results of calculations - submission of an updated calculation is carried out at the request of the policyholder.

By complying with the registration requirements and correctly performing computational steps, the enterprise will be able to correctly calculate insurance premiums in 2017. Instructions for filling out and useful recommendations prepared for you will help you avoid accounting errors. Below, as an example, you can calculate the calculations for the 1st quarter of 2017 in Excel format.

Since 2017, report and pay. In addition to contributions for injuries. Instead of the usual RSV-1 and 4-FSS, tax inspectors will approve a new unified form. For the new calculation of insurance premiums, see letter dated July 18, 2016 No. BS-4-11/12915. There is also a procedure for filling out the new form.

The new report takes up 24 sheets (how do you like that!). And is divided into three large sections. In addition to general information about accruals, contributions, payments. There are sheets and applications for calculating benefits and reduced tariffs. For personalized information – section 3 of the future calculation.

The new calculation includes all contributions, except for injuries. The latter will continue to be contributed to the Russian Social Insurance Fund. As before, social insurance will determine the tariff based on. And allocate funds for preventive measures. You will pay for injuries. The shape of which also changes.

Control of calculation of insurance premiums using Federal Tax Service formulas(.pdf 694Kb)How to make a calculation of insurance premiums (ERSV), detailed instructions(.pdf 635Kb)Examples for calculating ERSV using real figures (more than 20 examples)(.pdf 1092Kb)Note: Some answers to questions about filling out contributions for the 1st half of 2017

to menu

Composition of a single new calculation for insurance premiums - ERSV

The new calculation in its content will combine the four currently existing forms: RSV-1, RV-3, RSV-2 and 4-FSS. Naturally, duplicate and unnecessary indicators will be excluded from a single calculation. The calculation will consist of the following sections:

- title page;

- information about an individual - not an individual entrepreneur;

- summary data on the obligations of the payer of insurance premiums;

- calculation of insurance premiums for compulsory health insurance and medical insurance;

- calculation of contributions for compulsory social insurance;

- expenses for compulsory social insurance in case of temporary disability and in connection with maternity;

- decoding of payments made from funds financed from the federal budget;

- a number of applications required to apply the reduced insurance premium rate;

- summary data on the obligations of insurance premium payers of heads of peasant (farm) households;

- calculation of the amounts of insurance premiums payable for the head and members of a peasant (farm) enterprise;

- personalized information about insured persons.

Do you know what is the most common mistake in the calculation of insurance premiums and in SZV-M, due to which reports will not be accepted? Incorrect SNILS of employees. Even the correct value of the code in the report will be considered an error if it differs from the data of the Federal Tax Service or the fund.

to menu

Employers are required to submit the following declaration sheets

1 . All employers without exception

- title page;

- section 1;

- subsections 1.1 and 1.2 of Appendix No. 1 to Section 1;

- Appendix No. 2 to Section 1;

- section 3

2 . Employers paying contributions at additional rates and/or applying reduced rates

- subsections 1.3.1, 1.3.2, 1.3.3, 1.4 of Appendix No. 1 to Section 1;

- Appendix No. 2 to Section 1;

- appendices No. 5-10 to section 1;

- section 3

3 . Employers who incurred expenses in connection with the payment of compulsory social insurance in case of temporary disability and in connection with maternity

- Appendix No. 3 to Section 1;

- Appendix No. 4 to Section 1;

to menu

The Federal Tax Service demands an explanation of why contributions were paid before the due date.